So the income statement is related to the balance sheet. And it’s … What I mean by that is the income statement is a period of time. The balance sheet, you recall, was a snapshot in time, so like one day. This reports … You could report one day, but generally there’s going to report a month, six months, a quarter, a year. And generally speaking you close the income statement. And what that means … at the end of a period. And closing it basically means you take all your income and expense accounts back to zero, you move the net income or net loss back over to the balance sheet in the equity section. That’s where that goes. That retained earnings or equity section. And that’s basically what retained earnings means. It means income that has been moved out of the income statement and moved into the balance sheet. Most small businesses do that at the end of the year. And they may not know they’re doing it, their accountant’s probably doing it for them. And we can talk about that in a little more detail.

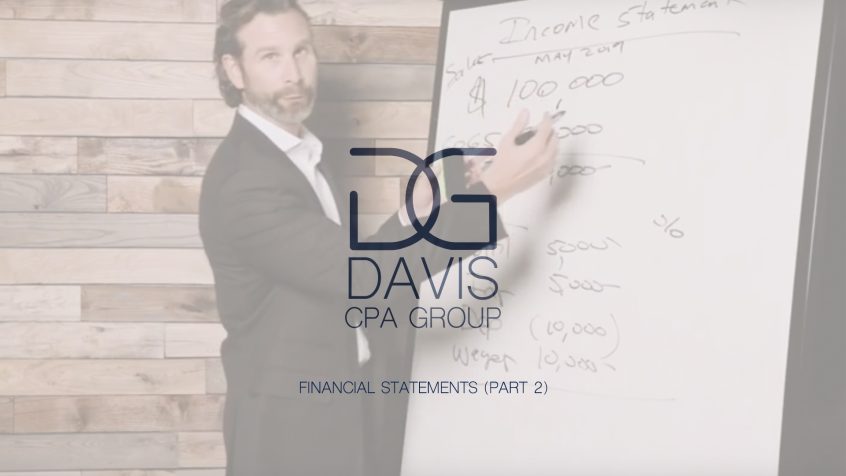

But the income statement’s going to show me things like the revenues, sales. Let’s say … Let’s say this is just one month. This is May 2019. And so we had total sales of $100,000. Maybe we make something and so maybe we have costs of goods sold. So we’ll call this sales. I know I’m not doing a good job of doing this part. Maybe we sell something. So we have costs that go into making this widget, I don’t know, maybe we make toy cars or something along those lines.

So you got $100,000 in sales. It costs us $50,000 in materials and maybe labor, so that’s cost of goods sold. So it gets us down to what’s called a gross profit number, I’m just going to call it GP, of $50,000. And so I’m showing you a little bit more complex of an income statement by using this approach. Because then after the gross profit number, you’re going to have your operating expenses. A lot of times these are called like selling, general, and administrative expenses. Or SG&A is what you might hear it termed as. That’s where you’re going to have like your utility expenses, insurance expenses, depreciation expense. You know the depreciation we took on the balance sheet at $10,000, you know maybe that represented one month’s worth. So we’ve got a month’s worth of depreciation now on the expense side over here. So those kind of offset each other.

So let’s say, maybe we have utility expense of $5000. And we’ve got insurance expense of $5000. And then maybe we have wages down here, because we have employees that we pay. Maybe for the month that was another $10,000. So now you can see we have $50,000 in gross profit. We have utility expenses, insurance, depreciation. And you may have all kinds of expenses. What you put on your income statement as a line item is really dependent on, one, the type of business you are, what you want to track from an analytical perspective. Because one of the big things that this report’s good for, helping you show trends. Are you making money? Is one of these expenses getting out of line? And you want to look at this on maybe a trailing 12 months, where you look at the most recent month and go backwards. We’ll do another video about analytics and what to really dig into and look at it.

But the other things you might want to look at is percent of your total income. Or percent of your gross margin of these expenses versus other expenses. And then what that looks like in May versus June or July. Because then you can start seeing trends. Say, “Man our utility expenses are ridiculous. What’s going on?” Maybe someone’s leaving the water on in the bathroom, I don’t know. But these are things that … This is a tool then for you to look at the profitability of your business and then figure out is there ways we can dial in and do something different? Also, you want to benchmark. Meaning you want to look at this, compare it to your other peers in the same industry to say, “Am I doing as good as they are? What are they doing that’s so much better than us? And let’s learn from that.” So this is what this is telling you.

So then we kind of take this a step further. Gross income, which is sales. Cost of goods sold, because that’s the cost associated with making this item. So now we got our gross profit. These are what’s called our operating or selling, general, and administrative expenses. So we have $50,000 here, 5000, another five, that’s 10. Here’s 20,000 in depreciation. Or I’m sorry, 10,000 depreciation and 10,000 in wages. So there’s 30,000 in expenses here. So we have profit then, or what they call net income, of $20,000.

So this is what your income statement does. All the cash inflow and outflows of your business associated with generating a profit hit the income statement. So sales to customers, expenses out the door. And that may not be writing a check. It could be you got bills in. We talked about I think in some other videos about cash versus accrual accounting. Well this is the income statement where you report those activities.